The dollar index is looking for more stable support

- The dollar index has been in a bullish trend since Tuesday when it fell to 100.50

Dollar index chart analysis

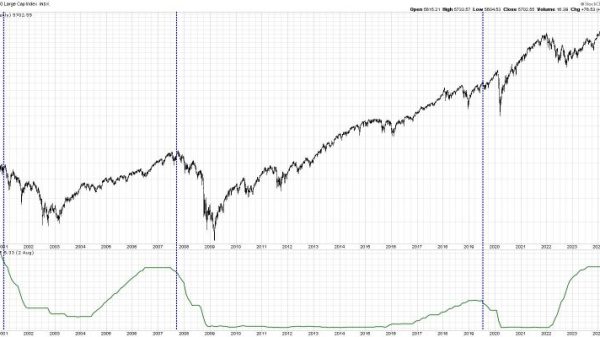

The dollar index has been in a bullish trend since Tuesday when it fell to 100.50. After forming a new low, the index successfully stabilized and started a bullish consolidation up to the 101.00 level. On Thursday, we saw a slight pullback to 100.90, where a higher low was formed compared to the previous one.

From that level, the bullish consolidation continued until the 101.57 level. Here, we encountered resistance, and there was a loss of momentum. In the continuation up to now, the movement takes place in the 101.25-101.40 range. We have slight support from the EMA 200 moving average. Based on that picture, we expect a new impulse to the bullish side and the formation of a new weekly high. Potential higher targets are the 101.80 and 102.00 levels.

The index with the support of moving averages has the opportunity for a bigger recovery.

For a bearish option, we need a drop in the dollar index below 101.20 and the EMA 200 moving average. There, we get new resistance in the EMA 50 moving average, thereby increasing the pressure on the index to start a further retreat to a new daily low. Potential lower targets are 101.00 and 100.80 levels. This week’s low is a step lower at the 100.50 level.

In the EU session, we had news about inflation in the Eurozone. The published data were in line with economists’ predictions: inflation was 2.8%, 0.1% less than a month earlier. In the US session, we will also have some strong economic news: Core PCE Price Index, Chicago PMI, and Canadian GDP. US news should impact the movement of the dollar index, depending on the published data.

The post The dollar index is looking for more stable support appeared first on FinanceBrokerage.