EURAUD and EURNZD: Euro tries to stop further retreat

- During this morning’s Asian trading session, EURAUD moved in the 1.62600-1.62950 range

- During this morning’s Asian trading session, EURNZD received support at the 1.76600 level

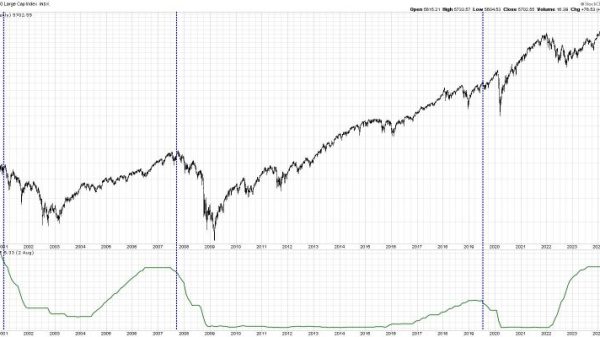

EURAUD chart analysis

During this morning’s Asian trading session, EURAUD moved in the 1.62600-1.62950 range. Only now, at the beginning of the US session, do we see the strengthening of the bullish option and a jump to the 1.63120 level. We have bullish momentum that could continue to push the pair to a new daily high. By moving above 1.63300, we will get the support of the EMA 50 moving average for further resistance to the bullish side.

Potential higher targets are the 1.63400 and 1.63600 levels. The EMA 200 moving average is in the zone of 1.64350 levels. For a bearish option, we need a negative EURAUD consolidation and a return below the 1.63700 level. With that step, we are moving to a new daily low and will be close to testing the weekly low at the 1.62580 level. Potential lower targets are the 1.62400 and 1.62200 levels.

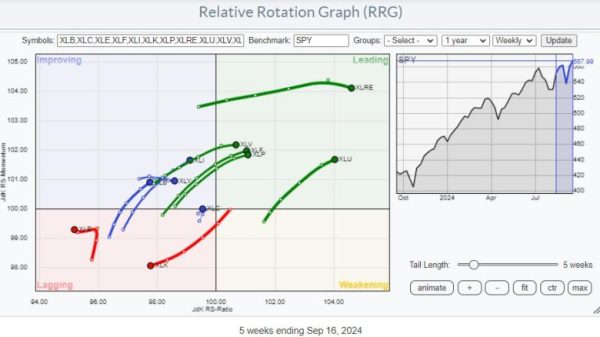

EURNZD chart analysis

During this morning’s Asian trading session, EURNZD received support at the 1.76600 level. The pair started a bullish consolidation from that place and recovered to the 1.77100 level. In this zone, we will try to move above the 1.77400 level and the EMA 50 moving average. If we succeed in this, we will be better positioned to continue on the bullish side.

There’s also potential for loss with the 1.77500 and 1.78000 levels as higher targets. For a bearish option, we need a negative consolidation and a return to the 1.76500 level. This will push us to a new weekly low and thus strengthen the bearish momentum. Potential lower targets are the 1.76000 and 1.75500 levels.

The post EURAUD and EURNZD: Euro tries to stop further retreat appeared first on FinanceBrokerage.