Hi, what are you looking for?

Stock

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced since...

Stock

Is the market’s next surge already underway? Find out with Tom Bowley’s breakdown of where the money is flowing now and how you can get...

Stock

The chart of Meta Platforms, Inc. (META) has completed a roundtrip from the February high around $740 to the April low at $480 and...

Stock

After a very strong move in the week before this one, the markets chose to take a breather. They moved in a wide range...

Stock

This week, while everyone else is focused on NVIDIA Corp. (NVDA), we will focus our attention on stocks with earnings that may get overlooked....

Stock

In this insightful overview, Grayson dives into StockCharts’ powerful scanning capabilities. He shows you how to navigate the markets quickly with the sample scan...

Stock

My main question going into this weekend was, “Will the S&P 500 finish the week above its 200-day moving average?” And while the S&P 500...

Stock

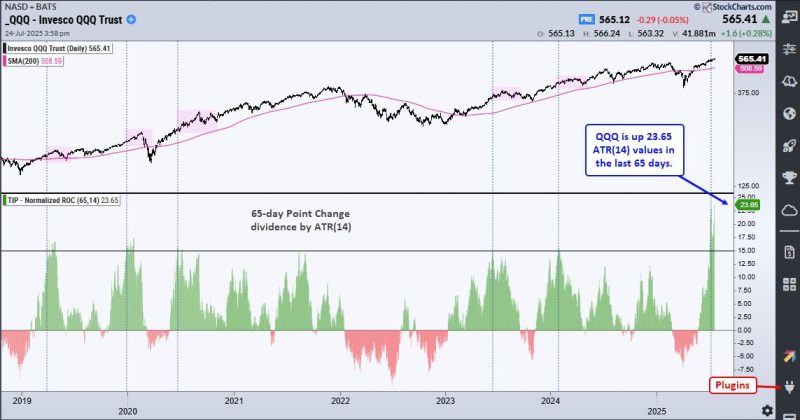

The bullish signals stacked up in April and May, but most long-term breadth indicators are still bearish. SPY and QQQ showed signs of capitulation...

Stock

It scares me to admit I’ve been investing for over 50 years. It’s been a great ride, and fortunately I’m still going strong. One...

Stock

On Wednesday, only 4% of the S&P 500’s holdings logged gains — a pretty rare occurrence. Since the start of 2024, this has only...

Stock

In this video, Joe shares how to use MACD and ADX indicators to analyze stock pullbacks, focusing on the good while avoiding the weak...

Stock

Retail traders and investors often don’t get the credit they deserve. But in April, they showed they’ve got serious market smarts. While headlines screamed...

Stock

If you regularly follow the SCTR Reports (StockCharts Technical Rank), you’ll notice that some top-ranked stocks aren’t just individual standouts but groupings that call...